Teaching Fin Lit in Arkansas: Building Wealth

What are ways I can save money? How can the money I save grow over time? How do interest rates work? What types of things should I be saving money for? Young adults who are curious about earning and saving money are asking these questions.

Every year Forbes magazine compiles a list of the wealthiest people in America. Bill Gates, Jeff Bezos, and Warren Buffett all appear at the top of the list year after year. So how did these people build wealth? They all started their own businesses and amassed great fortunes by providing a product or service in high demand. While most of us will never achieve this level of wealth, we can all create enough wealth over time to live very comfortably in retirement. Using savvy saving strategies, many of us have the ability to become millionaires.

During Summer 2020, Dr. Mike Casey, Professor of Finance at the University of Central Arkansas, partnered with the Arkansas Center for Research in Economics to develop a set of curriculum units for teaching personal finance topics to Arkansas students. Each unit includes lesson plans, activities, discussion guides, and AMI options for virtual learners.

Building Wealth

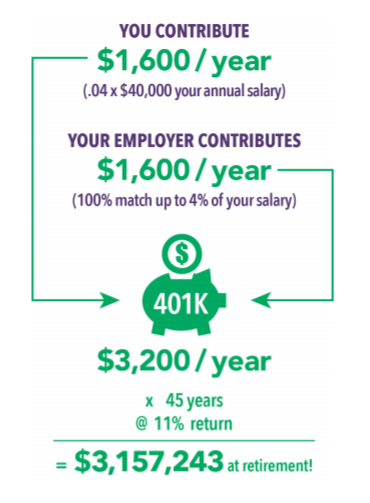

Students learn how retirement contributions and employee matching can lead to large savings.

The Building Wealth curriculum guides students through saving and building wealth over time. Students begin by discussing goals that they have and what actions they will need to take to reach those goals. Students are presented with several examples to discuss with their classmates and practice goal setting. Once these goals are established, students take next steps, planning out career options, and using pay rates from those careers to create budgets and a plan to reach their short and long term goals. Students learn about the different savings options and accounts offered through financial institutions and the power of compounding interest over various lengths of time. Each topic is explored through the activities and assessment materials included in the curriculum. For an example, in the "What Kind of Bank Account Should I Open" activity, students research and compare savings rates over a variety of traditional and online banking options to see where and how long it would take to grow their wealth. The Stock Market Game program from Economics Arkansas is another great activity that can be incorporated into this unit, guiding students through building an investment portfolio. Through all of the materials, students learn the importance of setting realistic short and long term goals, budgeting their incomes, and creating savings plans.

Connections to Arkansas Learning Standards:

The Building Wealth curriculum provides multiple days worth of content with topics that include Setting SMART goals, evaluating financial institutions and products, and creating savings plans. The multi-day curriculum can be shortened or expanded to meet each teachers unique classroom needs. Several Arkansas learning standards for personal finance have been imbedded into the curriculum including:

PFM.8.E.2: Evaluate a variety of strategies for making personal financial goals to build short-term and long-term wealth

PF.5.MM.1: Compare types of banking institutions including products and services available

PFM.8.E.2: Critique components of personal money management in order to build short-term and long-term wealth

PF.7.SI.8: Understand the regulation of savings and investments

Additional Resources To Expand Your Unit:

Building Good Financial Habits

This 38 minute podcast was created by NPR. The strategies included in the companion article come from the book The Power of Habit: Why We Do What We Do in Life and Business by Charles Duhigg.

The Stock Market Game™ is a national program of the SIFMA Foundation that allows students and teachers the opportunity to invest a virtual $100,000 in stocks, bonds and mutual funds throughout an engaging 13-week simulation each semester. A year-long session is also available that begins in September and ends in April.

Economics Arkansas has been the facilitator of this program in Arkansas since 1999. Check out their website to see how the game is making such a huge difference in the Arkansas classroom: https://www.economicsarkansas.org/for_teachers/stock_market_game.html